SWP Calculator

Disclaimer:The above return calculation is only for illustrative purposes. It should not be considered as investment advice. Consult your Financial Advisor/ Financial Distributor before investing.

A SWP (Systematic Withdrawal Plan) Calculator is a tool that helps investors calculate the amount they can withdraw from their mutual fund investments at regular intervals, typically monthly or quarterly, after the corpus has been accumulated. This strategy is the reverse of a SIP (Systematic Investment Plan), where instead of investing money regularly, the investor withdraws a fixed amount periodically.

An SWP is commonly used by investors who have accumulated wealth through SIPs or lump sum investments and want to generate a regular income stream from their investments. It’s an excellent option for individuals looking for post-retirement income or for those who want a predictable, periodic cash flow.

How Does a SWP Work?

In an SWP, you invest a lump sum amount into a mutual fund, and then you start withdrawing a fixed sum regularly from the accumulated corpus. This withdrawal continues until the investment lasts or the investor decides to stop the withdrawals.

Unlike SIP, where the money is invested into the mutual fund, SWP is designed to withdraw money from the fund, often used by retirees to fund their expenses. The main goal of SWP is to provide regular income while maintaining the growth potential of the investment.

SWP Calculator Formula

The formula for calculating the withdrawal amount from your mutual fund investments through an SWP is based on the following principles:

- Monthly Withdrawal: You can decide how much to withdraw on a monthly or quarterly basis.

- Expected Return: The mutual fund is expected to earn a certain rate of return, but this rate can vary based on market conditions.

- Duration: The number of months (or years) you expect to make withdrawals.

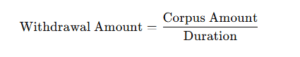

The basic formula for calculating the SWP is:

Where:

- Corpus Amount = The total amount of money in the mutual fund.

- Duration = The time period (in months or years) over which you wish to withdraw.

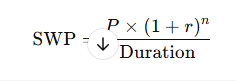

If you want to factor in the expected return from the mutual fund, the future value of your investments over time needs to be considered. The formula to calculate the SWP considering returns would be:

Where:

- P = Initial corpus (investment amount)

- r = Rate of return per period (monthly or yearly)

- n = Number of periods (months or years)

Example of SWP

Let’s take an example to understand the working of an SWP better:

- Corpus Amount: Rs. 10,00,000 (lump sum investment in a mutual fund)

- Monthly Withdrawal: Rs. 20,000

- Expected Annual Return: 8% per annum (or 0.67% per month)

- Duration: 5 years (60 months)

Step 1: Calculate the SWP considering the expected returns.

- Corpus = Rs. 10,00,000

- Monthly Withdrawal = Rs. 20,000

- Annual Return = 8% (or 0.67% per month)

- Duration = 60 months

The calculator will factor in the returns of 0.67% per month and show how much of the principal is left after each withdrawal, adjusting for the interest earned on the remaining corpus.

Step 2: SWP Calculation

For each month, the following will happen:

- The monthly return is applied to the corpus.

- The fixed withdrawal amount is deducted from the corpus.

- This process continues until the corpus is exhausted (or the investor decides to stop).

Result:

At the end of 5 years, the SWP will show how much of the original Rs. 10,00,000 corpus is remaining and how much has been withdrawn, considering the interest earned during the withdrawal period.

Benefits of SWP

Regular Income: SWPs provide a regular income stream, which is especially useful for retirees or individuals who need a predictable cash flow from their investments.

Flexibility: SWPs offer flexibility in terms of the amount to be withdrawn and the frequency of withdrawals. You can withdraw monthly, quarterly, or even yearly, based on your needs.

Tax Efficiency: In many cases, mutual fund withdrawals are taxed based on the holding period. Long-term capital gains (LTCG) from equity funds (after holding for 1 year) are generally tax-free up to a certain limit, which makes SWP more tax-efficient than other income options like fixed deposits.

No Forced Withdrawal: If you do not need the entire amount, you can either withdraw less or stop the SWP altogether, giving you control over your funds.

Retain Growth Potential: Withdrawing a fixed amount periodically allows you to retain the remaining amount in the mutual fund, which can continue to grow, depending on market conditions.

Helps in Maintaining Discipline: By setting up an SWP, investors ensure that they don’t withdraw large amounts from their investments prematurely, maintaining a disciplined approach to their portfolio.

How to Use an SWP Calculator?

To use an SWP calculator, follow these simple steps:

- Enter the Corpus Amount: Input the total amount you have invested in the mutual fund (e.g., Rs. 10,00,000).

- Enter the Monthly/Quarterly Withdrawal Amount: Specify how much you want to withdraw regularly (e.g., Rs. 20,000 per month).

- Enter the Expected Rate of Return: Input the expected annual or monthly return from the mutual fund (e.g., 8% annually or 0.67% monthly).

- Enter the Duration: Specify how long you want to make the withdrawals (e.g., 5 years or 60 months).

- Click Calculate: The calculator will give you the total amount withdrawn over time, the remaining corpus, and other relevant information like total earnings.

Conclusion

A SWP Calculator is a powerful tool for those looking to create a systematic, regular income stream from their mutual fund investments. It provides clarity on how much you can withdraw, how long your corpus will last, and how much growth your investment will continue to experience during the withdrawal phase. SWPs are an effective way to achieve financial stability, especially in retirement, while ensuring that the principal amount continues to grow.