Sukanya Samriddhi Yojana Calculator

Current Interest Rate: 8.2% per annum

This interest rate is valid from 1st Jan 2024 to 31st March 2025.

Disclaimer : The above return calculation is only for illustrative purposes. It should not be considered as investment advice. Consult your Financial Advisor/ Financial Distributor before investing.

A Sukanya Samriddhi Yojana (SSY) Calculator is a tool used to estimate the maturity amount of investments made under the Sukanya Samriddhi Yojana scheme, which is a government-backed savings scheme designed for the benefit of a girl child. The scheme offers a high rate of interest and comes with tax benefits. It encourages parents or guardians to save for the education and marriage of their daughters.

Key Features of Sukanya Samriddhi Yojana (SSY):

- Eligibility: The scheme is available for girls below the age of 10 years, with a maximum of two accounts per family.

- Investment Amount: The minimum deposit is Rs. 250 per year, and the maximum deposit is Rs. 1.5 lakh per year.

- Interest Rate: The government sets the interest rate for the scheme quarterly, and it is typically higher than regular savings accounts or Fixed Deposits. The current rate is around 7.6% per annum (though this may change based on government announcements).

- Compounding: Interest is compounded annually.

- Maturity: The account matures after 21 years from the date of opening the account, though partial withdrawals can be made for the girl’s higher education after she turns 18.

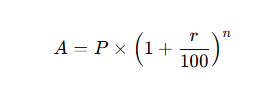

Sukanya Samriddhi Yojana Formula:

The future value (maturity value) of an SSY account can be calculated using the compound interest formula:

Where:

- A = Maturity amount (Principal + Interest)

- P = Deposit amount (yearly deposit)

- r = Interest rate (annual, compounded yearly)

- n = Number of years the money is invested

Example Calculation:

Let’s consider an example where:

- Annual Deposit (P) = Rs. 50,000

- Interest Rate (r) = 7.6% (annually)

- Investment Duration (n) = 21 years

We’ll use the formula to calculate the future value of the investment.

Features of the Sukanya Samriddhi Yojana Calculator:

- Annual Contributions: The calculator will prompt you to enter the annual contribution (minimum Rs. 250 and maximum Rs. 1.5 lakh).

- Interest Rate: You will need to input the interest rate applicable for the current financial year (typically around 7.6% annually).

- Duration: The number of years (typically 21 years) for which you will be investing.

- Maturity Amount: The calculator will compute the maturity amount, which includes both your principal and the interest accrued over the years.

Benefits of the Sukanya Samriddhi Yojana Calculator:

- Accurate Maturity Calculation: It helps you calculate the total maturity amount based on the amount you plan to invest and the interest rate, giving you an idea of how much you will receive after 21 years.

- Financial Planning: You can plan your savings and investment goals for your daughter’s future by knowing how much the SSY will grow over time.

- Tax Benefits: The investment in Sukanya Samriddhi Yojana is eligible for tax deductions under Section 80C of the Income Tax Act, and the interest earned is also tax-free, making it a tax-efficient investment.

- Transparency: The calculator ensures you understand the impact of your annual contributions and how compounding affects the growth of the investment.

How to Use a Sukanya Samriddhi Yojana Calculator:

Enter the Annual Deposit Amount: Enter how much money you plan to invest each year. The minimum is Rs. 250, and the maximum is Rs. 1.5 lakh per year.

Enter the Interest Rate: Enter the interest rate applicable for the current financial year. (It typically changes every quarter, but you can use the current rate for an estimate.)

Enter the Duration of Investment: Enter the number of years for which you will make the investment. The scheme matures after 21 years from the date of account opening.

Click Calculate: Once you enter all the details, click on the calculate button to get the maturity amount.

Factors to Consider While Using the Calculator:

Interest Rate Changes: The interest rate on the Sukanya Samriddhi Yojana changes periodically. Ensure that you are using the current rate for the most accurate results.

Partial Withdrawals: After the girl turns 18, partial withdrawals can be made for her education. These withdrawals will impact the final maturity amount.

Investment Duration: The full benefit of compounding is realized if you stay invested for the full 21 years. If you withdraw early, you may not receive the maximum benefit.

Conclusion:

A Sukanya Samriddhi Yojana Calculator is a valuable tool for parents or guardians planning to save for the future of a girl child. By using this tool, you can estimate the total amount that your investment will grow into over time, helping you plan ahead for your daughter’s education and marriage. The scheme’s tax advantages, high-interest rate, and government backing make it an attractive and secure option for long-term saving.