Step-Up SIP Calculator

Disclaimer : The above return calculation is only for illustrative purposes. It should not be considered as investment advice. Consult your Financial Advisor/ Financial Distributor before investing.

A Step-Up SIP Calculator is a tool designed to help investors calculate the future value of a Systematic Investment Plan (SIP) where the investment amount increases periodically at a predetermined rate. This approach is also known as a Step-Up SIP or Increasing SIP, and it is ideal for investors who expect their income to grow over time and want to increase their monthly investments accordingly to accelerate wealth accumulation.

How Does a Step-Up SIP Work?

In a Step-Up SIP, instead of investing the same fixed amount every month, you gradually increase the amount of your SIP at regular intervals, typically annually. The increase in the SIP amount is usually a fixed percentage, and this is what the Step-Up SIP Calculator helps you estimate: how your investment will grow when the SIP amount increases periodically.

For example, you may start with an SIP of Rs. 10,000 per month, but every year you increase it by 10% so that after the first year it becomes Rs. 11,000 per month, after the second year it becomes Rs. 12,100 per month, and so on.

Step-Up SIP Formula

The Step-Up SIP formula is an extension of the traditional SIP formula. Since the SIP amount increases at regular intervals (typically every year), the future value of the investment is calculated for each phase of the SIP, where the SIP amount increases, and the returns are compounded.

Here’s the general process:

- Initial SIP Calculation: The initial SIP is calculated using the traditional SIP formula, where the SIP amount remains constant for the first year.

- Step-Up for the Next Years: After the first year, the SIP amount is increased by the step-up percentage (e.g., 10% or 20%).

- Future Value Calculation for Each Year: Each year’s SIP amount is compounded based on the new increased value, and the process continues for the entire tenure of the SIP.

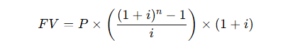

The formula for Step-Up SIP can be expressed as:

Where:

- FV = Future Value of SIP

- P = SIP Amount (Initial amount for Year 1)

- i = Monthly Compounded Rate of Return (Annual rate of return divided by 12)

- n = Number of Months (Investment duration in months)

For the step-up part:

- Step-Up Percentage = Percentage increase in SIP (e.g., 10%, 15%, etc.)

- Frequency of Step-Up = Usually annually (every 12 months)

Example of Step-Up SIP

Let’s take an example to understand the calculation better:

- Initial SIP Amount: Rs. 10,000 per month

- Step-Up Percentage: 10% annually

- Expected Annual Return: 12% (or 1% per month)

- Duration: 5 years (60 months)

Step 1: First Year

- SIP Amount: Rs. 10,000

- Duration: 12 months

- Return Rate: 12% annually

Calculate the future value of the SIP for the first year.

Step 2: Second Year

- SIP Amount: Rs. 10,000 + 10% = Rs. 11,000

- Duration: 12 months (for the second year)

- Return Rate: 12% annually

Calculate the future value for the second year, but now the SIP amount is Rs. 11,000.

Step 3: Repeat the Process

- Increase the SIP amount by 10% every year for the remaining duration of the investment.

Step 4: Combine Results

- The future value for each year is calculated separately, and then the results are combined to find the total future value of your investment.

Benefits of Step-Up SIP

Accommodates Income Growth: Step-Up SIP is ideal for individuals who expect their income to increase over time. By gradually increasing the investment amount, the investor can build wealth at a faster rate without feeling the financial strain.

Compounding Advantage: With the increase in SIP amount over time, the power of compounding accelerates, leading to greater wealth accumulation, especially in long-term investments.

Inflation Hedge: Increasing your SIP regularly can help offset inflation. As the cost of living increases, so does your investment, ensuring your savings grow in line with your financial goals.

Disciplined Investing: A Step-Up SIP enforces a disciplined approach to investing and encourages investors to save more as their income grows.

Better Wealth Creation: Over the long term, a Step-Up SIP results in significantly higher corpus compared to a traditional SIP, as the increasing SIP amount benefits from compounded returns.

How to Use a Step-Up SIP Calculator?

Using a Step-Up SIP calculator is easy and can be done in a few simple steps:

- Enter the Initial SIP Amount: Input the amount you plan to invest in the first month (e.g., Rs. 10,000).

- Step-Up Percentage: Enter the percentage by which you plan to increase the SIP amount annually (e.g., 10%).

- Expected Annual Return: Input the expected rate of return on your investment (e.g., 12% per annum).

- Investment Duration: Specify the total number of months or years you plan to invest (e.g., 5 years or 60 months).

- Calculate: The calculator will calculate the total future value of your Step-Up SIP, considering the SIP increases over time.

Conclusion

A Step-Up SIP Calculator is an excellent tool for investors who plan to increase their SIP amounts periodically in alignment with their growing income. It helps estimate the total future value of such investments, taking into account the power of compounding and regular increases in the SIP amount. This strategy is especially beneficial for long-term financial planning and can help you achieve your financial goals more effectively.