SIP with Lumpsum Calculator

Expected Returns

A SIP with Lumpsum Calculator is a tool that helps investors calculate the future value of their investment when they invest through both a Systematic Investment Plan (SIP) and a Lumpsum amount. This type of investment strategy involves making regular monthly contributions (SIP) along with a one-time lump sum investment, which is typically added at the start of the investment period.

This calculator is beneficial for investors who want to know the combined returns from both their SIP and lump sum investments in a mutual fund scheme.

How Does the SIP with Lumpsum Calculator Work?

The calculator calculates the future value of both your SIP contributions and lump sum investments separately and then combines them to provide the total maturity value at the end of the investment period.

Here’s how it works:

SIP Contributions:

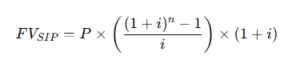

- It uses the SIP formula to calculate the maturity value for your regular monthly contributions. The formula typically used is:

- Where:

- FVₛᵢₚ = Future Value of SIP

- P = SIP Amount (monthly contribution)

- i = Monthly Compounded Rate of Return (Annual rate of return divided by 12)

- n = Number of Months (duration of SIP in months)

Lumpsum Investment:

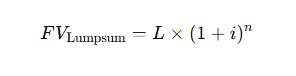

- For the lump sum portion, the future value is calculated using the compound interest formula:

- Where:

- FVₗᵤₘpsᵤᵐ = Future Value of Lump Sum

- L = Lump Sum Amount

- i = Monthly Compounded Rate of Return

- n = Number of Months (investment duration)

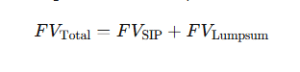

Combined Future Value:

- The future value of both SIP and Lump Sum investments are then added together to calculate the total maturity value.

Formula for SIP with Lumpsum

The total future value (FV) combining both SIP and Lump Sum investments would be:

Where:

- FVₜₒᵗₐₗ = Combined Future Value of SIP and Lump Sum

Example Calculation:

Let’s assume the following scenario:

- SIP Amount: Rs. 10,000 per month

- Lump Sum Investment: Rs. 1,00,000

- Annual Expected Return: 12% (or 1% per month)

- Duration: 5 years (60 months)

SIP Calculation:

- Using the formula, you can calculate the future value of the SIP portion.

Lump Sum Calculation:

- Similarly, calculate the future value of the lump sum amount invested.

Total Future Value:

- Add both values to find the total future value of your combined investment.

Benefits of SIP with Lump Sum Investment Strategy:

- Flexibility: This approach allows you to invest both in small, regular amounts (SIP) while making a larger, one-time investment (lump sum).

- Diversification: A combined strategy allows you to spread the risk. SIPs invest regularly, while the lump sum provides the potential for larger gains over time.

- Goal-Based Investing: You can use this strategy for different financial goals like retirement planning, purchasing property, or saving for your child’s education.

- Compounding Power: Both SIP and lump sum investments benefit from the power of compounding, especially when invested for the long term.

How to Use the SIP with Lump Sum Calculator?

To use a SIP with lump sum calculator, follow these simple steps:

- Enter the SIP Amount: Input the monthly SIP contribution you wish to make.

- Enter the Lump Sum Amount: Input the one-time lump sum investment.

- Enter the Expected Annual Return: This is the rate of return you expect from your mutual fund investments (typically in percentage).

- Enter the Investment Duration: This is the number of years (or months) you plan to invest for.

- Calculate: The calculator will provide the future value of your SIP and lump sum investments, along with the combined maturity amount.

Conclusion

A SIP with Lump Sum Calculator is a valuable tool for those looking to invest both regularly and with a larger upfront sum. It helps investors understand how their different investments will grow over time and gives them a clearer picture of the total returns they can expect at the end of their investment horizon. By combining SIP and lump sum investments, you can benefit from both disciplined investing and the potential for higher returns.