Lumpsum Calculator

Disclaimer : The above return calculation is only for illustrative purposes. It should not be considered as investment advice. Consult your Financial Advisor/ Financial Distributor before investing.

A Lumpsum Investment Calculator is a tool used to calculate the future value of a single large investment made at the beginning of a certain period, typically in mutual funds, stocks, or other investment vehicles. Unlike Systematic Investment Plans (SIPs), where you invest small amounts periodically, a lumpsum investment involves investing a one-time, large sum of money with the hope that it will grow over time through the power of compounding.

The Lumpsum Calculator helps investors determine the potential returns on their investment based on factors such as the initial investment amount, expected rate of return, and the investment duration.

How Does a Lumpsum Investment Work?

When you make a lumpsum investment, you invest a fixed amount at the beginning of the investment period. This amount grows over time based on the rate of return provided by the investment vehicle (e.g., mutual funds, stocks, or bonds). The value of the investment increases as the return compounds, and the longer you stay invested, the more you benefit from compounding.

The main idea behind lumpsum investing is to capitalize on the growth potential of the asset over time. It’s often a good strategy for those who have a significant amount of money to invest upfront and want to grow it without having to make regular contributions.

Lumpsum Investment Formula

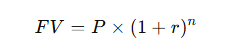

The formula to calculate the future value (FV) of a lumpsum investment is based on the principle of compound interest. The formula used is:

Where:

- FV = Future Value of the investment (the amount you will have after the investment period)

- P = Principal or initial amount invested

- r = Rate of return (annual rate of return, expressed as a decimal)

- n = Number of periods (typically in years)

Example of Lumpsum Investment Calculation

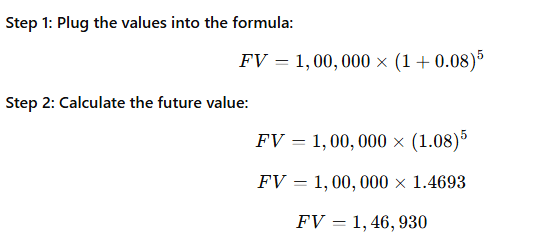

Let’s take an example to better understand how the lumpsum investment formula works:

- Principal Amount (P) = Rs. 1,00,000

- Annual Rate of Return (r) = 8% (0.08 as a decimal)

- Investment Duration (n) = 5 years

So, after 5 years, your Rs. 1,00,000 investment at an 8% annual return will grow to Rs. 1,46,930.

Benefits of Lumpsum Investment

Potential for Higher Returns: If you invest a large amount upfront, your money has more time to grow and benefit from the power of compounding. Long-term investments typically generate better returns than short-term ones, especially if the investment is in high-growth assets like equities.

One-Time Investment: Unlike SIPs where you have to make regular contributions, a lumpsum investment requires a one-time commitment, making it convenient for people who have a large sum of money available for investment.

Compounding Power: The longer you stay invested, the more your returns compound. This is why lumpsum investments made early in life or well before you need the funds can yield substantial growth over time.

Ideal for One-Time Surpluses: If you receive a large amount of money as a lump sum (e.g., a bonus, inheritance, or a windfall), a lumpsum investment allows you to put that money to work for you.

Better for Risk-Tolerant Investors: Since lumpsum investments involve market exposure, it can be riskier than regular SIPs, especially in the short term. However, if you have a higher risk tolerance and can stay invested for a longer period, the returns can be substantial.

How to Use a Lumpsum Calculator?

To use a Lumpsum Calculator, follow these steps:

Enter the Initial Investment Amount: Specify the amount of money you want to invest (e.g., Rs. 1,00,000).

Enter the Expected Rate of Return: Provide the expected annual return rate. This could be the historical average return for the asset you plan to invest in, such as a mutual fund or stock (e.g., 8%).

Enter the Duration of Investment: Specify how long you plan to keep the investment (e.g., 5 years, 10 years).

Click Calculate: The calculator will compute the future value of your lumpsum investment, based on the provided data.

Factors to Consider While Using a Lumpsum Calculator

Market Volatility: The rate of return is often based on past performance, which may not always reflect future returns. The stock market, in particular, can be volatile, so you may need to adjust your expected return accordingly.

Investment Risk: Lumpsum investing typically involves taking on more risk, especially in equities. Make sure you understand the level of risk involved and choose investment options that align with your risk tolerance.

Inflation: Inflation erodes the purchasing power of your returns over time. Consider how inflation will affect the real value of your investment.

Investment Strategy: While lumpsum investments can yield higher returns, they may not always be suitable for everyone. Investors with lower risk tolerance may prefer SIPs, which spread the investment over time and reduce the impact of market volatility.

Conclusion

A Lumpsum Investment Calculator is an essential tool for estimating the potential future value of a one-time investment. By understanding the growth of your investment based on factors like rate of return, duration, and compounding, you can make more informed decisions about how to allocate your funds. Lumpsum investing is best suited for those who have a significant amount of money to invest upfront and are comfortable with market risks in the pursuit of higher returns.