Inflation Calculator

Disclaimer : The above return calculation is only for illustrative purposes. It should not be considered as investment advice. Consult your Financial Advisor/ Financial Distributor before investing.

An Inflation Calculator is a tool that helps you estimate the future value of money by factoring in inflation. Inflation erodes the purchasing power of money over time, and the inflation calculator helps you understand how inflation will affect the value of your savings, investments, or expenses in the future.

Key Features of an Inflation Calculator:

- Future Value of Money: It calculates how much a certain amount of money today will be worth in the future after considering inflation.

- Inflation Rate: You can input the expected average inflation rate over a specific period, typically given as a percentage.

- Time Period: You can specify how many years into the future you want to calculate the impact of inflation.

- Present Value: You input the current amount of money to see how it will change in value over time.

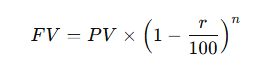

Formula Used in Inflation Calculation:

To calculate the future value (FV) of money considering inflation, the following formula is used:

Where:

- FV = Future value (what the money will be worth in the future)

- PV = Present value (the amount of money today)

- r = Inflation rate (annual rate of inflation)

- n = Number of years (time period)

This formula assumes that inflation will reduce the value of money over time (as inflation increases, the value of money decreases).

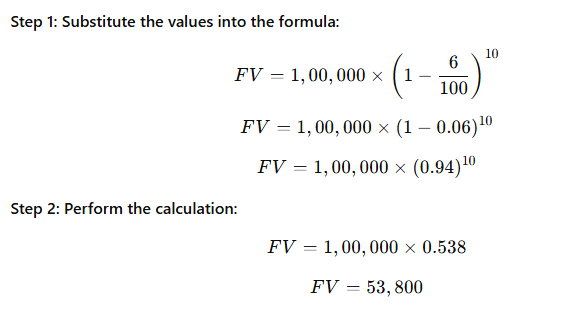

Example Calculation:

Let’s say you have Rs. 1,00,000 today, and you expect the inflation rate to be 6% annually. You want to calculate the future value of this amount after 10 years.

After 10 years, the purchasing power of Rs. 1,00,000 would be equivalent to Rs. 53,800 today, assuming a 6% annual inflation rate.

Steps to Use an Inflation Calculator:

- Enter Present Value: This is the current amount of money you have (e.g., your savings, investment, or a planned expense).

- Enter Inflation Rate: Input the expected annual inflation rate. Inflation is typically in the range of 3% to 6% in most countries, but you can adjust this value depending on your assumptions or country-specific data.

- Enter Time Period (in Years): Specify how many years into the future you want to calculate the effect of inflation. This could be 1 year, 5 years, 10 years, or more.

- Calculate: Click the calculate button to get the future value (FV) of your money after accounting for inflation.

Benefits of Using an Inflation Calculator:

Planning for the Future: It helps you understand how inflation will affect your savings, investments, and future expenses. For example, if you’re saving for a large purchase (like a car or a house) in the future, the inflation calculator helps you plan accordingly.

Investment Strategy: If you are investing, understanding inflation’s impact helps you make better decisions regarding the growth rate of your investments to outpace inflation.

Purchasing Power: It helps you determine how inflation will reduce the purchasing power of your money in the future. For instance, if you are planning retirement, knowing how much your expenses will rise due to inflation can help you save more today.

Improved Financial Decisions: The calculator helps you factor in inflation while making long-term financial decisions, whether it’s about retirement planning, saving for education, or estimating the future cost of goods.

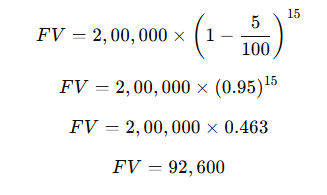

Example Scenario (Inflation Calculator Use):

- Present Value: Rs. 2,00,000 (your current savings)

- Inflation Rate: 5% annually

- Time Period: 15 years

Let’s calculate the future value of your Rs. 2,00,000 after 15 years at an annual inflation rate of 5%.

Step 1: Use the formula

After 15 years, the Rs. 2,00,000 you have today will be equivalent to only Rs. 92,600 in terms of purchasing power, assuming a 5% inflation rate.

Conclusion:

An Inflation Calculator is a useful tool for anyone who wants to understand how inflation impacts their finances over time. It can be used to plan for future expenses, evaluate the growth potential of investments, and adjust savings goals to account for inflation. By using this tool, you can make more informed financial decisions that help preserve and grow the value of your money over time.