What is behavioural bias in finance?

Behavioural bias in finance refers to the psychological factors that impact investors’ decision-making in financial markets. It involves the interpretation and action taken based on specific information. Researchers in the field of behavioural finance have identified various mental shortcuts, known as heuristics, which can influence judgments and lead to financial mistakes. These biases are unconscious beliefs that have the potential to affect money and investments.

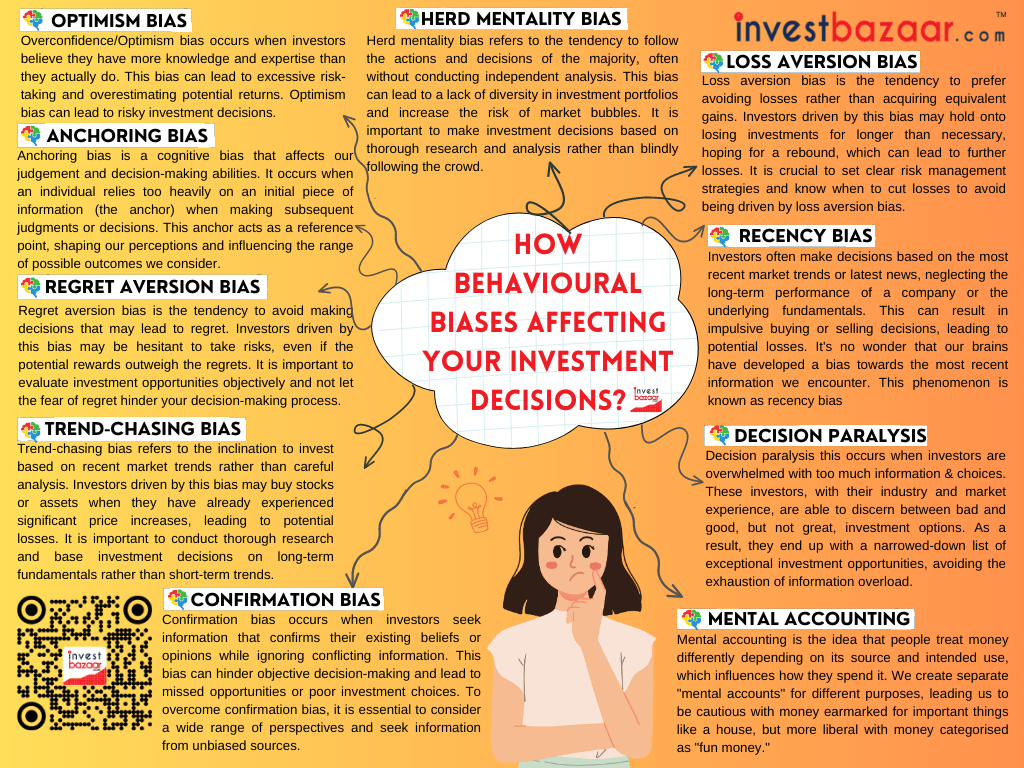

Understanding and avoiding behavioural biases in investment decision-making is crucial, as many of our life choices, including investments, are influenced by emotions. Failing to consider other factors and getting trapped by these biases can lead to regrettable investment decisions. It is important to recognize and overcome these below mentioned biases to make informed investment choices.

At investbazaar.com, we believe in empowering investors with the knowledge they need to make sound investment decisions. In this article, we will discuss some common behavioural biases that can impact your investment decisions.

1. Overconfidence/Optimism Bias: Overconfidence bias occurs when investors believe they have more knowledge and expertise than they actually do. This bias can lead to excessive risk-taking and overestimating potential returns. It is crucial to maintain a realistic understanding of your abilities and seek expert advice to avoid overconfidence bias. Overconfidence bias can lead to risky investment decisions.

For example: Mr. A, an experienced investor, believed that the stock of XYZ Ltd. would increase from ₹918 to ₹1125 in a quarter, based on his past success. Despite ignoring other factors, he allocated 35% of his net worth to shares of XYZ Ltd. Similarly, Mr. B was enticed by a friend’s claim that investing ₹5,00,000 in a scheme would quickly double his money in two years. Without fully understanding the scheme, Mr. B invested based on overconfidence in the information he received. These examples highlight the dangers of overconfidence bias. It is important to overcome this bias to avoid potential financial difficulties.

2. Trend-Chasing Bias: Trend-chasing bias refers to the inclination to invest based on recent market trends rather than careful analysis. Investors driven by this bias may buy stocks or assets when they have already experienced significant price increases, leading to potential losses. It is important to conduct thorough research and base investment decisions on long-term fundamentals rather than short-term trends.

For example: Trend-chasing bias can be seen when Mr. A bought 1000 shares of XYZ Ltd. solely because it generated an 80% return in the previous year. This indicates that Mr. A is influenced by trends. Despite the fact that past performance may not accurately predict future performance, a significant number of investors base their investment choices mainly on past returns. This inclination can result in unwise investment decisions.

3. Regret Aversion Bias: Regret aversion bias is the tendency to avoid making decisions that may lead to regret. Investors driven by this bias may be hesitant to take risks, even if the potential rewards outweigh the regrets. It is important to evaluate investment opportunities objectively and not let the fear of regret hinder your decision-making process.

For example: Mr. A who bought 250 shares of a stock after analysing its low probability of losing significant value. However, as time passed, the stock’s value started to decline. Despite this, Mr. A chose not to sell the stock when the potential loss was smaller, sticking to their initial investment decision. Unfortunately, the stock price continued to drop, resulting in a significant loss of value. Although Mr. A had the opportunity to exit the investment with a small loss and invest elsewhere, they opted to avoid the regret of making a poor investment decision. Many investors experience similar situations, where they are driven by the desire to avoid regret. This tendency is known as regret aversion bias. Investors affected by this bias may end up wasting more money and time than necessary, in terms of opportunity cost, simply to avoid regretting a wrong decision. Consequently, this bias can hinder investors from making timely and appropriate decisions.

4. Anchoring Bias: Anchoring bias is a cognitive bias that affects our judgement and decision-making abilities. It occurs when an individual relies too heavily on an initial piece of information (the anchor) when making subsequent judgments or decisions. This anchor acts as a reference point, shaping our perceptions and influencing the range of possible outcomes we consider. Anchoring plays a significant role in investing.

For Example: People tend to rely on the 52-week high or low price as a buying or selling indicator for stocks. Another tendency is to anchor to the original purchase price of a stock. It is not uncommon to hear investors say they will only sell a stock once it reaches the price, they initially paid for it. However, it’s important to remember that the market does not consider what price was paid for a stock.

5. Confirmation Bias: Confirmation bias occurs when investors seek information that confirms their existing beliefs or opinions while ignoring conflicting information. This bias can hinder objective decision-making and lead to missed opportunities or poor investment choices. To overcome confirmation bias, it is essential to consider a wide range of perspectives and seek information from unbiased sources.

Confirmation bias occurs when an investor selectively believes and seeks out information that aligns with their preconceived notions while disregarding conflicting information.

For example: Mr.A conducted thorough research before investing in XYZ co. and had a positive outlook on the company’s future. Despite receiving news of potential international law violations and the risk of hefty fines leading to insolvency, Mr. A chose to ignore this information intentionally because it did not support his belief in the company’s strength. This behaviour exemplifies confirmation bias, where investors tend to overlook information that contradicts their existing beliefs.

6. Herd Mentality Bias: Herd mentality bias refers to the tendency to follow the actions and decisions of the majority, often without conducting independent analysis. This bias can lead to a lack of diversity in investment portfolios and increase the risk of market bubbles. It is important to make investment decisions based on thorough research and analysis rather than blindly following the crowd.

For example: Mr. A, driven by the fear of missing out (FOMO) on a potentially lucrative opportunity, succumbed to the herd mentality bias. He came across a penny stock that was creating a buzz in the online community. Seeing numerous investors reap substantial profits from this stock, Mr. A blindly decided to follow suit. This behaviour exemplifies the herd mentality bias. Rather than conducting independent analysis, many investors opt to buy stocks simply because others are doing so. The inherent issue with this approach is that it can lead to negative consequences, as blindly following the crowd without understanding can backfire.

7. Loss Aversion Bias: Loss aversion bias is the tendency to prefer avoiding losses rather than acquiring equivalent gains. Investors driven by this bias may hold onto losing investments for longer than necessary, hoping for a rebound, which can lead to further losses. It is crucial to set clear risk management strategies and know when to cut losses to avoid being driven by loss aversion bias.

For example: Mr. A possesses ₹2,00,000 in savings. However, he hesitated to invest in mutual funds or stocks due to their volatile nature, as he was concerned about potential losses. While traditional saving options such as FDs and Post Office schemes may not adequately cover inflation, investing has the potential to grow his savings. Unfortunately, his fear of losing money prevented him from taking the plunge. This example demonstrates Mr. A’s loss aversion bias, which refers to the tendency of investors to prioritise avoiding losses over seeking gains. Overcoming this bias and making mindful investments can yield future benefits.

8. Recency Bias (also known as availability bias): In today’s fast-paced world, information is readily available at our fingertips. With the rise of social media and 24/7 news cycles, it’s no wonder that our brains have developed a bias towards the most recent information we encounter. This phenomenon is known as recency bias. One of the most notable areas where recency bias can be observed is in the financial markets. Investors often make decisions based on the most recent stock market trends or news, neglecting the long-term performance of a company or the underlying fundamentals. This can result in impulsive buying or selling decisions, leading to potential losses. To overcome availability bias, investors should gather comprehensive information from multiple sources and conduct thorough due diligence.

For example: In the event of a market crash, investors may anticipate its continuation, leading them to hesitate in making investments and straying from their financial objectives.

9. Decision Paralysis: Decision paralysis, also known as choice analysis, is not limited to the investment domain but is commonly observed in everyday life as well. It occurs when individuals are overwhelmed with too much information & choices including investors. These investors, with their industry and market experience, are able to discern between bad and good, but not great, investment options. As a result, they end up with a narrowed-down list of exceptional investment opportunities, avoiding the exhaustion of information overload. To simplify the decision-making process, one can rely on their financial advisor to provide the best choices and start building wealth confidently today, rather than second-guessing tomorrow.

For Example: When it comes to making choices, like deciding on a vacation destination or assembling a complete wardrobe, having an abundance of options can sometimes make it difficult to decide. The availability of a wide range of choices can lead to decision paralysis, as it becomes challenging to thoroughly analyse all the options and make the best decision. As the saying goes, “you must seize the opportunity while it’s still available.”

10. Mental Accounting: Mental accounting, a concept introduced by Nobel Prize-winning economist Richard Thaler in 1999, involves assigning different values to money based on subjective criteria, which often leads to negative outcomes. Mental accounting is the idea that people treat money differently depending on its source and intended use, which influences how they spend it. We create separate “mental accounts” for different purposes, leading us to be cautious with money earmarked for important things like a house, but more liberal with money categorised as “fun money.”

This explains why people are more likely to splurge on luxury items with unexpected windfall gains, but would save the same amount if they had earned it. In simpler terms, we tend to view money from one source as more significant than money from another source. This behaviour also applies to investing and can result in irrational decision-making.

By understanding and overcoming these behavioural biases, you can make more informed investment choices. At investbazaar.com, we are committed to providing tools, resources, and expert advice to help you navigate the complex world of investments. Remember, staying informed and disciplined is key to achieving your investment goals. If you are planning to invest in equity probability mutual funds are the best option which mitigates any concentrated securities risk and gives you diversification without considerable investment.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as investment advice. Please consult with a professional financial advisor before making any investment decisions.