Deposit Calculator

A Deposit Calculator is a tool that helps investors or savers calculate the maturity amount of a fixed deposit (FD) or recurring deposit (RD) based on factors such as the initial deposit amount, interest rate, and the duration of the deposit. It allows you to estimate the total return you will receive at the end of the deposit period, taking into account the interest earned over time.

Types of Deposits:

Fixed Deposit (FD): A fixed sum of money is deposited for a predetermined period (typically ranging from 7 days to 10 years) at a fixed interest rate. The interest is compounded either quarterly, monthly, or annually, and the principal and interest are paid out at the end of the term.

Recurring Deposit (RD): This is a type of deposit where you contribute a fixed amount regularly (usually monthly) into the deposit account. The interest is compounded at regular intervals, and the maturity amount is paid out at the end of the term.

Both FDs and RDs are considered low-risk investment options that are suitable for conservative investors looking for guaranteed returns.

Key Parameters for Using a Deposit Calculator:

Principal Amount (P): The initial amount that you deposit into the FD or RD account. For an FD, this is a lump sum, while for an RD, it is the monthly deposit amount.

Interest Rate (R): The rate of interest offered by the bank or financial institution on the deposit. The rate may vary based on the deposit duration and the type of deposit (FD or RD).

Compounding Frequency: The frequency at which the interest is compounded (annually, quarterly, monthly). For example, monthly compounding means interest is added to the principal every month.

Deposit Duration (T): The time period for which the money is invested. For FDs, this is the fixed term, while for RDs, this is the total number of months you will be depositing money.

Maturity Amount: The total amount you will receive at the end of the deposit term, including both the principal and the interest earned.

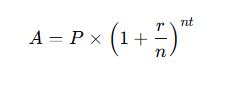

Formula for Calculating Maturity Amount for FD

For Fixed Deposits, the maturity amount is calculated using the formula for compound interest:

Where:

- A = Maturity amount (Principal + Interest)

- P = Principal amount

- r = Annual interest rate (decimal form)

- n = Number of times the interest is compounded per year (quarterly = 4, monthly = 12, annually = 1)

- t = Time period in years

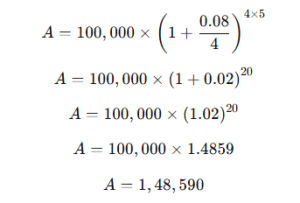

Example Calculation for FD:

Let’s say you invest Rs. 1,00,000 in a fixed deposit for 5 years at an annual interest rate of 8%, compounded quarterly.

- Principal (P) = Rs. 1,00,000

- Annual interest rate (r) = 8% = 0.08

- Compounding frequency (n) = 4 (quarterly)

- Duration (t) = 5 years

Using the formula:

So, the maturity amount after 5 years will be Rs. 1,48,590, which includes both the principal and the interest.

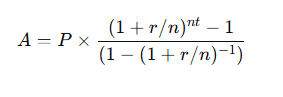

Formula for Calculating Maturity Amount for RD

For Recurring Deposits, the maturity amount can be calculated using the following formula:

Where:

- A = Maturity amount

- P = Monthly deposit amount

- r = Annual interest rate (in decimal form)

- n = Number of times the interest is compounded per year

- t = Time period in years

Alternatively, many RD calculators will simply ask you to enter the monthly deposit amount, interest rate, and duration, and they will automatically compute the total maturity value for you.

Example Calculation for RD:

Let’s say you make monthly deposits of Rs. 5,000 into an RD for 3 years, with an annual interest rate of 7%, compounded quarterly.

- Monthly deposit (P) = Rs. 5,000

- Annual interest rate (r) = 7% = 0.07

- Compounding frequency (n) = 4 (quarterly)

- Duration (t) = 3 years

Using the formula for RD maturity:

The RD calculator will calculate the maturity amount after 3 years, considering the compounding frequency and interest rate.

Benefits of Using a Deposit Calculator:

Easy Calculation: A deposit calculator saves you time and effort by providing accurate maturity amounts based on the input parameters.

Helps with Financial Planning: It allows you to plan your future savings and investments more effectively by giving you a clear picture of how much your deposit will grow over time.

Comparison Tool: You can use the calculator to compare different deposit options with varying interest rates, compounding frequencies, and durations to find the most suitable option.

Accurate Results: With a deposit calculator, you can easily calculate the maturity amount of your FD or RD without making manual calculations, reducing the chance of errors.

How to Use a Deposit Calculator:

For Fixed Deposit (FD):

- Enter the initial deposit amount.

- Specify the interest rate offered by the bank or financial institution.

- Select the compounding frequency (monthly, quarterly, annually).

- Enter the investment duration in years.

- Click “Calculate” to get the maturity amount.

For Recurring Deposit (RD):

- Enter the monthly deposit amount.

- Specify the interest rate offered by the bank or financial institution.

- Select the compounding frequency (monthly, quarterly, annually).

- Enter the duration in years (or months).

- Click “Calculate” to get the maturity amount.

Factors to Consider When Using a Deposit Calculator:

Interest Rate: The rate of interest can significantly affect the maturity amount. Higher interest rates will yield better returns.

Compounding Frequency: The more frequently the interest is compounded, the higher the returns. Monthly compounding typically offers the highest returns, followed by quarterly and annual compounding.

Investment Duration: Longer durations generally yield higher returns due to the power of compounding. Early withdrawals may result in a lower maturity amount.

Taxation: The interest earned on fixed and recurring deposits is taxable. Consider the tax implications while using the calculator to estimate post-tax returns.

Conclusion

A Deposit Calculator is an essential tool for anyone looking to invest in Fixed Deposits (FDs) or Recurring Deposits (RDs), helping you estimate your potential returns and plan for future financial goals. Whether you are looking for a one-time lump sum investment (FD) or a regular contribution plan (RD), the calculator provides accurate results and simplifies the process of financial planning.