Published on Feb 01, 2025

Key Highlights from the Union Budget 2025-26

Tax Relief for Middle and Upper-Middle-Class Individuals

Union Finance Minister Nirmala Sitharaman has presented the FY 2025-26 budget, introducing several measures that could impact businesses and individuals. Here are the key announcements:

The government has proposed a tax rebate for individuals with a taxable income of up to ₹12 lakh under the new tax regime. Including the standard deduction of ₹75,000; salaried individuals earning up to ₹12.75 lakh will now be exempt from tax.

Additionally, retired individuals receiving SWP income from fixed income funds can opt for the new tax regime, securing tax exemptions on income up to ₹12 lakh.

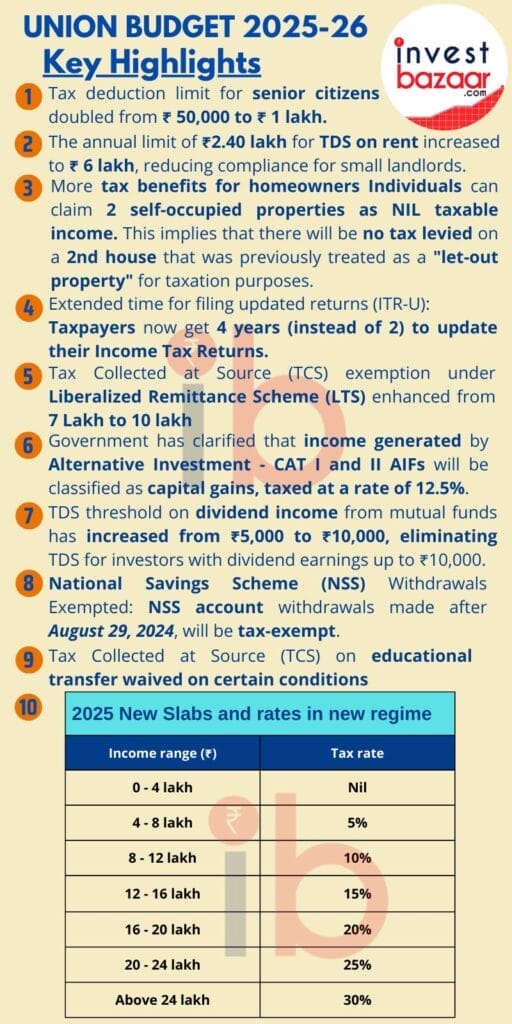

The new tax slabs under the revised tax structure can be shown in infographic attached here.

These revised tax rates are expected to reduce the tax burden for upper-middle-income earners. The FM highlighted the following savings:

- A taxpayer earning ₹12 lakh will save ₹80,000, equivalent to 100% of tax payable under the existing regime.

- A person with ₹18 lakh income will save ₹70,000 (30% of current tax payable).

- Someone earning ₹25 lakh will benefit by ₹1,10,000 (25% of current tax payable).

Changes in Mutual Funds, Insurance & Alternative Investment Funds (AIFs)

- Mutual Funds: The TDS threshold on dividend income from mutual funds has increased from ₹5,000 to ₹10,000, eliminating TDS for investors with dividend earnings up to ₹10,000.

- To address tax uncertainty for Alternative Investment Funds (AIFs), the government has clarified that income generated by Category I and II AIFs will be classified as capital gains, taxed at a rate of 12.5%.

Previously, if such income was categorized as business income, it would have been taxed at 30% for residents and up to 39% for non-residents. This clarification on the treatment of gains from the sale of investments by AIF-I and AIF-II is a positive step, enhancing investor confidence in the AIF ecosystem. It offers significant relief to unit holders, who will now be taxed at the lower capital gains rate of 12.5%, rather than the higher business income tax rate of 25%-35%. - Insurance: The government has increased FDI in insurance to 100%, attracting more investment in the sector.

- ULIPs & endowment policies from GIFT City – Currently, the maturity proceeds of ULIPs and endowment policies sold in India are tax-free under Section 10(10D), provided their annual premiums do not exceed Rs 2.5 lakh. However, Budget 2025 has introduced a concession for ULIPs sold by insurance companies operating through their branches in GIFT City’s International Financial Services Centre (IFSC).

Under the new provision, the maturity proceeds of life insurance policies issued by IFSC insurance intermediaries will be exempt from tax without any restrictions on the maximum premium payable. This move aims to create parity for non-residents purchasing life insurance from IFSC offices compared to other foreign jurisdictions.

The differential tax treatment between domestic insurance policies and those offered by IFSC-based insurers raises the possibility of tax arbitrage. This could attract high-net-worth individuals seeking tax-efficient investment options to explore GIFT City insurance policies. The long-term impact of this provision remains to be seen.

NPS Vatsalya & National Savings Scheme (NSS) Benefits

- NPS Vatsalya, a pension scheme for minors, will now qualify for tax deduction under Section 80CCD. Parents investing in this scheme can claim deductions of up to ₹50,000 per year, similar to the regular NPS account.

- Withdrawals from the National Savings Scheme (NSS) will now be tax-free, allowing individuals to enjoy tax-exempt income from the scheme.

Favorable Tax Changes for Wealthy Individuals

- Individuals can now hold up to two self-occupied properties without incurring taxation on the second home.

- Previously, a second home was treated as a let-out property, and tax was levied on its notional rental income—whether rented out or not. This taxation has now been removed.

Simplified KYC Process

- The government has announced the implementation of a simplified KYC regime, streamlining compliance.

- A central KYC registry will be introduced by 2025 to enhance efficiency.

Other Key Announcements

- The fiscal deficit target has been revised to 4.8% of GDP for 2024-25.

- For FY 2025-26, the fiscal deficit target is set at 4.4% of GDP.

- Capital expenditure (Capex) has been increased to ₹10.18 lakh crore to boost infrastructure growth.

- The government has proposed reducing basic customs duties on various products and services.

- Insurance companies setting up offices in IFSCA (International Financial Services Centres Authority) will receive special benefits.

These budgetary measures aim to provide tax relief, encourage investments, boost economic growth, and simplify compliance for individuals and businesses.