Published on June 01, 2024 Article by Shankar Parab Reviewed by Sachin Kolekar

As the world’s largest democracy heads to the polls, the anticipation and outcomes have profound implications for investors, both domestic and international. The 2024 Lok Sabha election is expected to be a particularly crucial one, with far-reaching consequences for India’s economic policies and financial markets. The outcome of elections often significantly impacts policy makers which cascading impacts the Indian economics & Industries influencing earning & key indices like the Sensex and Nifty. Market news frequently highlights how elections on the Indian economic landscape affect market dynamics, influencing market indices, stock prices, and mutual funds. India’s general elections can boost the pre-election market, leading to a positive outlook for various sectors and companies, contingent on the perceived stability of the government.

Historical Context: Elections and Market Reactions of general election

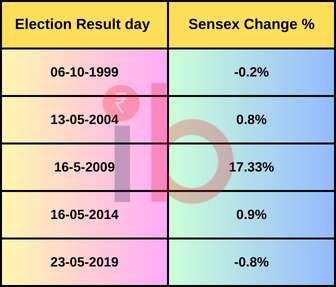

Historically, Indian elections have had a notable impact on the stock markets. Market volatility tends to increase in the run-up to elections due to uncertainty about the policy directions that new governments might take. For instance, on the 16th May 2014 elections result, the stock market witnessed a significant rally after the Bharatiya Janata Party (BJP) secured a decisive victory, leading to expectations of economic reforms and business-friendly policies. Similarly on the day of 23rd May 2019 election results, we saw a positive market response, as continuity in government led to investor confidence in policy stability. The impact on the market from the Congress party’s performance in elections can lead to broader economic changes, with post-election market dynamics often resulting in significant market fluctuations.

However, market reactions are not always positive. In the case of a hung parliament or a coalition government with differing economic agendas, markets can become jittery, reflecting concerns over policy paralysis and instability. Therefore, the political landscape resulting from the 2024 elections will be crucial in determining the market trajectory.

Key Factors Influencing Market Sentiment

Policy Continuity vs. Change:

The primary concern for investors is the continuity of economic policies. The incumbent BJP-led government has implemented several significant economic reforms, including the Goods and Services Tax (GST), Insolvency and Bankruptcy Code (IBC), and various initiatives aimed at digitalization and infrastructure development. A clear mandate for the current government would likely mean a continuation of these policies, which could boost investor confidence.

On the other hand, if the opposition secures a significant victory, there could be a shift in economic priorities and policies. While this is not necessarily negative, the initial period of adjustment and uncertainty could lead to market volatility. Investors will closely watch for the opposition’s economic agenda, especially regarding reforms, fiscal policies, and foreign investment regulations.

Fiscal Policy and Budgetary Priorities:

The government’s fiscal policy is another critical factor. Election years often see increased government spending aimed at social schemes and infrastructure projects to win voter support. While this can stimulate economic activity in the short term, it also raises concerns about fiscal prudence and the budget deficit. Post-election, the markets will scrutinize the new government’s budget for signs of fiscal discipline or profligacy. Also if the ruling govt. changes then the interim budget will be scrapped and a new budget with different guidelines are announced.

Regulatory Environment:

Investors prefer a stable and predictable regulatory environment. Significant changes in regulatory policies, especially those affecting key sectors like banking, finance, infrastructure, and technology, can lead to market uncertainty. The new government’s stance on regulatory reforms and ease of doing business will be closely monitored.

Geopolitical and International Relations:

India’s geopolitical stance and international relations significantly influence market sentiment. A government perceived as strong on foreign policy can positively impact investor confidence, especially concerning trade relations, foreign direct investment (FDI), and international collaborations. Markets will be attentive to the new government’s approach towards key international partners like the United States, China, and the European Union.

Election impact on the stock of Specific Sector.

Different sectors of the economy will be affected variably based on the election outcomes and subsequent policy directions.

- Banking and Financial Services: The banking sector, which has been undergoing significant transformation, could see varied impacts. A government focused on continuing financial reforms and addressing non-performing assets (NPAs) can instil confidence. Measures to strengthen public sector banks, promote financial inclusion, and encourage digital banking will be critical.

- Infrastructure and Real Estate: The infrastructure sector is likely to benefit from any government with a strong focus on development projects. Continued investment in infrastructure can drive growth in construction, real estate, and allied industries. Policies aimed at housing, smart cities, and rural development will be significant for this sector.

- Technology and Innovation: India’s burgeoning technology sector requires a conducive environment for growth and innovation. Policies that support startups, promote digital transformation, and foster research and development (R&D) will be crucial. Any government that prioritizes technological advancement and data security will likely be favored by the markets.

- Healthcare and Pharmaceuticals: The COVID-19 pandemic has underscored the importance of a robust healthcare system. Policies aimed at improving healthcare infrastructure, promoting pharmaceutical research, and ensuring public health security will impact the sector’s growth prospects.

- Energy and Environment: With global emphasis on sustainable development, the energy sector, particularly renewable energy, will be closely watched. A government committed to environmental sustainability, climate change mitigation, and renewable energy investments will likely gain market favor. Policies promoting clean energy, reducing carbon footprints, and ensuring energy security will be pivotal.

Investor Strategies and Market Sentiments impact on the stock market

- Pre-Election Period: In the months leading up to the election, markets are expected to be volatile. Investors might adopt a cautious approach, focusing on defensive stocks and sectors perceived as less risky. Blue-chip companies, particularly those with strong fundamentals and stable earnings, might be favoured.

- Post-Election Outcomes: The market’s response post-election will depend on the clarity of the mandate. A decisive victory for any party typically reduces uncertainty, leading to a market rally. Conversely, a fractured mandate or the prospect of a coalition government might lead to short-term market jitters.

- Long-Term Investment: For long-term investors, the focus should remain on the fundamentals of the economy and the structural reforms undertaken by the government. Sectors with strong growth potential, robust earnings, and favourable policy environments will remain attractive.

Global Perspective and FII Flows after election result

Foreign Institutional Investors (FIIs) play a crucial role in India’s financial markets. Election outcomes can significantly influence FII sentiment and investment flows. A stable government with clear policies is likely to attract more FII inflows, enhancing liquidity and market performance. Conversely, political uncertainty or policies perceived as unfriendly to foreign investment could lead to outflows, impacting market stability.

The global economic environment, including factors such as interest rates, trade policies, and geopolitical tensions, will also play a role. India’s positioning in the global market, along with its trade and investment policies, will influence FII decisions.

Conclusion

The general sentiment among investors toward the Indian market is cautious optimism but worried about the market making new highs every now and then however, the long-term outlook is viewed favorably. Investors are encouraged by the potential for economic stability and continued policy reforms expected after the 2024 elections.

Historically, elections in India have been pivotal in influencing market sentiment and investor behavior. The 2024 Lok Sabha election is poised to be a defining event for India, with substantial implications for the financial markets. Investors will keenly watch for signals of policy continuity, fiscal discipline, regulatory stability, and geopolitical strategies. While the election outcome will drive short-term market movements, the long-term trajectory will depend on the new government’s ability to implement growth-oriented policies and reforms.

As the political landscape unfolds, investors should stay informed and adopt strategies that balance caution with opportunities for growth, focusing on sectors with strong fundamentals and favorable policy outlooks. The election’s impact on India’s financial markets will be a testament to the intricate interplay between politics and economics in shaping the nation’s future.

Frequently Asked Questions (FAQ) :

Q 1. How do Lok Sabha elections typically affect the Indian stock market?

Answer: Lok Sabha elections often lead to increased market volatility due to uncertainty about future economic policies. Investors closely monitor election outcomes for indications of policy continuity or changes, which can significantly impact market sentiment. Historically, decisive victories have led to positive market reactions, while uncertain or fragmented outcomes have caused jitters and market instability.

Q 2. What sectors are most likely to be impacted by the 2024 Lok Sabha elections?

Answer: The banking and financial services, infrastructure and real estate, technology and innovation, healthcare and pharmaceuticals, and energy sectors are likely to be significantly impacted by the election outcomes. Policy directions in these sectors can lead to varied market reactions, depending on the government’s focus on reforms, development projects, and regulatory stability.

Q 3. How can investors prepare for market volatility during the election period?

Answer: Investors can prepare for market volatility by adopting a cautious approach in the pre-election period. This includes focusing on defensive stocks and sectors perceived as less risky, such as blue-chip companies with strong fundamentals and stable earnings. Diversifying investments and keeping a close watch on political developments can also help in managing risk.

Q 4. What is the potential impact of the 2024 election on foreign institutional investors (FIIs)?

Answer: The election outcome can significantly influence FII sentiment and investment flows. A stable government with clear and investor-friendly policies is likely to attract more FII inflows, enhancing market performance. Conversely, political uncertainty or policies perceived as unfriendly to foreign investment could lead to outflows, impacting market stability and liquidity.

Q 5. How important is the continuity of economic policies for market confidence?

Answer: Continuity of economic policies is crucial for market confidence. Investors prefer stability and predictability in policy directions. The current BJP-led government has implemented significant economic reforms, and a clear mandate for continuity could boost investor confidence. However, a shift in government could lead to initial uncertainty and market volatility as investors adjust to new economic priorities and policies.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as investment advice. Please consult with a professional financial advisor before making any investment decisions.